This week, I've been training my new consultant, who is FANTASTIC by the way. And her insightful questions have unveiled topics that I haven't covered in my blogs and should!

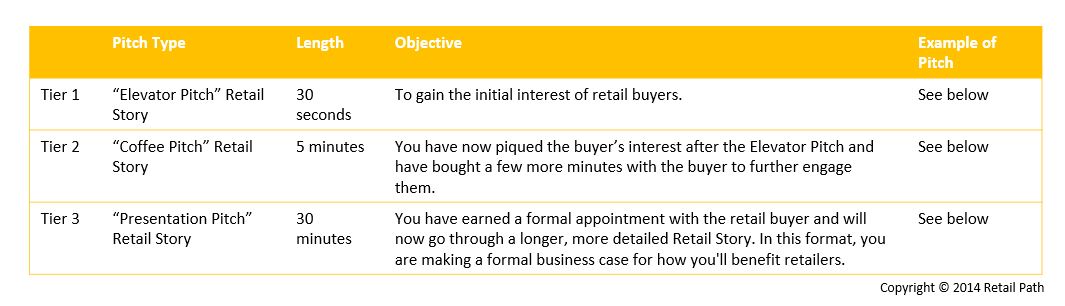

So without further ado, here are the different types of retail pitches any product entrepreneur will find themselves using at any point in time. I'll explain why you need to know these at the end.

Tier 1: “Elevator Pitch” Retail Story. Objective: To gain the initial interest of retail buyers. Length: 30 seconds

Usually this short-form Retail Story (AKA Retail Pitch) covers just the basics. It is a short description of your 1) product, 2) current retail distribution, 3) sales numbers and 4) past marketing success.

For example, "(Target Market) will use (Product X) to (solve this problem). (Product X) is currently sold in (Retailer 1), (Retailer 2) and we are in discussions with (Retailer 3). We average (X) Units Per Store Per Week in sales. Our last marketing feature in (Media Vehicle) drove sales lifts of 150% for our retailers. Do you have a few more minutes to discuss whether our line is a fit with your stores?"

This might be what you use at a trade show when you greet a buyer, sales rep or distributor that visits your booth. Or what you say when you get a buyer on the phone or come across the store manager in a boutique.

Tier 2: “Coffee Pitch” Retail Story. Objective: You have now piqued the buyer’s interest after the Elevator Pitch and have bought a few more minutes with the buyer to discuss further. Imagine you are having a quick informal discussion over coffee or you've bought a few more minutes of the buyer's time during that initial phone call or trade show booth visit. Length: 5 minutes.

The goal here is to offer more context or color commentary on the Elevator Pitch PLUS add a quick reassurance that your vendor execution is up to snuff.

For example, "(Product X) delivers the benefits of (benefit 1) and (benefit 2) and is different from current products in the market because of (Point of Difference). We can deliver these benefits better than our competition because of (Reason To Believe). (Product X) retails for (SRP) and we offer retailer margins of (x%). As for sales, our sales turn of (X) Units Per Store Per Week at (Retailer 1) is higher than the category average and higher than (Competitor 1). Sales have grown (X%) versus last year and we project it to grow another (X%) this year. We have the ability to support sales at shelf with our marketing plan. Past features include (list 3 to 5 key media vehicles) and our next feature will be (media vehicle) on (date). We are reliable vendors and execute well; our vendor scorecard ratings are all in the (% range). I'd love to sit down and walk you through what we propose for your store. Can I set up an appointment?"

Tier 3: “Presentation Pitch” Retail Story. Objective: You have earned a formal appointment with the retail buyer and will now go through a longer, more detailed Retail Story. In this format, you are making a formal business case for how you'll benefit retailers. Length: 30 minutes

The goal here is to go into detail on your sales history and forecasts, the recommended assortment for that retailer, plus your detailed marketing plan for how to support sales at shelf. You'll also align your proposals to their merchandising objectives and growth goals with analysis such as 'how you will add incremental sales to their assortment and not cannibalize current items on shelf', or 'how you build basket size through either multiple purchases or cross-purchasing with complementary items'. You will discuss at length vendor execution, inventory management, ship dates, and product testing. You will discuss pricing - SRP, wholesale cost and margin. You may also spend time talking about how to differentiate your product assortment from other retail channels.

I don't have an example for a "Presentation" Retail Story because it is unique to the retailer you are presenting to and to each business' strengths and weaknesses. But you can see what a template looks like here. My clients typically send the Retailer Pitch Deck to retailers they are cold-calling or are lukewarm. It's amazing how often we convert retailers interest with the Retailer Pitch Deck.

Finally, why is it important to differentiate these different pitch types in your proverbial 'sales tool kit'? You have to select the right level of information for the situation you are in. Obviously. But you'll be surprised how often buyers get turned off because the right information is not succinctly presented to them. Us buyers are impatient folks who get pitched to constantly. Cutting to the chase actually engages us. The categorizations above ensures you tailor your message to the buyer's frame of mind in the various occasions you might encounter them for maximum engagement.

I cannot tell you how often great brands get told "NO" because they don't tailor their message and just rattle on with information that is not relevant for that particular moment. Buyer's evaluate brands in stages. It's a filtering process. So help them filter by organizing your information in a way that aligns with their thought process. If there is one way you can make a buyer's life better ( and I'm pleading after years of frustration with bad pitches), it is to organize your pitch and tailor your message to the buyer.

This post also appears on Both Sides of the Retail Table (www.retailtable.com).